Mortgage Guide

Struggling to meet mortgage requirements? We'll help you take the steps necessary to become a qualified and trusted buyer.

Our Mortgage Guide Gives You

Home Product Education

guide to the loan product that best fits your needs--everything from government insured loans to down payment assistance.

Identify Non-Credit Factors

that lenders are typically looking for. While credit allows you to start the conversation, applying for a loan requires more than a 'good' FICO score.

Fast-Track Your Application

while you're working to qualify, start compiling the documentation you will need to speak with our lenders.

Mortgage Qualification Statistics

90% of mortgages purchased are by buyers with a credit score of 650 or higher.

A majority of lenders cap debt-to-income ratios at 36% of a borrowers income.

Most young first-time buyers put down 8%, which is a reasonable number to shoot for.

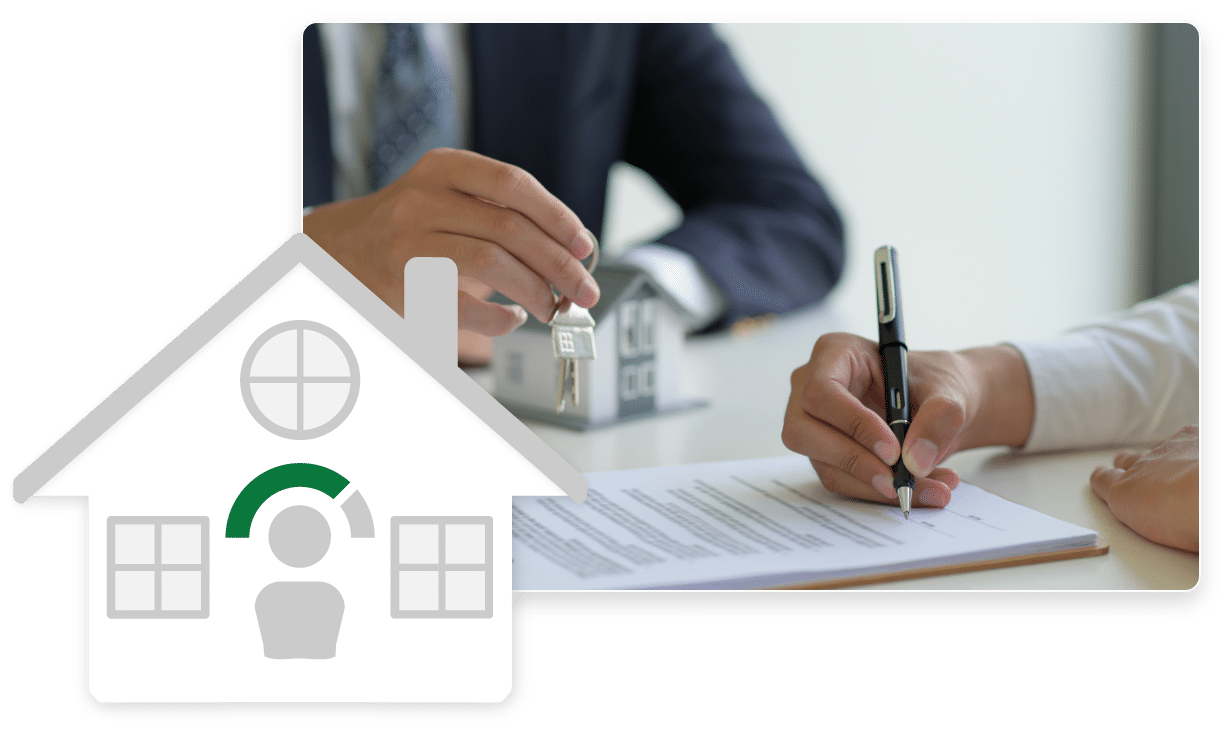

The CIG Mortgage Guide

Very often people fail to get into their own home because they meet obstacles as they try to accomplish the many different steps of the home buying process. When you sign up for CIG's platinum services your Credit Specialist will use the Mortgage Ready guide to help you navigate through each step, and when you come upon an issue, learn what it will take to solve the problem and get you right back on track. This will ensure that it's not a matter of "if" you can get into a home, but simply a matter of "when".

Remember that getting a mortgage and purchasing your own home is a difficult process. Everything worthwhile in this life comes at the expense of hard work and focus. If you will work closely with your credit specialist and never give up, we will get you across the finish line. The power of having someone in your corner that knows how to get this done, means your big financial goals are at your fingertips!

Get Real Credit Repair Results

Own Your Home

Faster Credit Approval

A Healthy Credit Profile

Lower Interest Rates

Increased Cashflow

Why People Love Credit Innovation Group

FAQ's

Our preferred lenders require the mid score to be no lower than 640 before they will start the mortgage process.

Each lender can decide what the lowest score they will work with is. Our preferred lenders require a 640+ score. However it is possible for lenders to finance an FHA mortgage with a score of 580 or higher. Some lenders will finance an FHA mortgage with a score of 580, but most lenders will require a higher score. We do not work with any lenders that will accept that low of a score.

In order to meet mortgage guidelines, you will be required to have two years of steady or increasing income.

In order to meet mortgage guidelines, you will be required to have two years of tax returns filed.

Yes Social Security Income can be used to get a mortgage, but in order to work with our preferred lenders the income will have to be higher than $1,000/month.

Unfortunately, unemployment is a temporary income so the lender will not let you use this towards getting a mortgage. You will need steady income that can support a mortgage payment long term in order to qualify.

The minimum loan amount that our lenders can finance is $50,000. In order to qualify for that loan amount, you must have an income over $1,000/month.

You will have to be purchasing an existing double wide trailer attached to a cement foundation in order to work with our preferred lenders.

Our preferred lenders are unable to finance a Home Equity loan or a loan for renovation.

Yes, our lenders are able to refinance a mortgage if you meet mortgage guidelines.

There are different requirements for late payments on an installment account and a revolving account. Below are the requirements for each type of account according to the guidelines our preferred lenders follow.

- You cannot have any late payments on any installment accounts within 12 months.

- There is no requirement for 30 day lates on a revolving account, but you can only have up to two 60 day lates, and no 90, 120, 180 day lates within 12 months.

You will be required to season the bankruptcy two years from the date of discharge before you will be eligible to meet mortgage guidelines. Usually on a credit report the date will be listed under date resolved. If there is only a date that it was filed, and no resolve date, that means the bankruptcy has not been discharged yet. If this is the case and the bankruptcy has not been discharged, you will need to wait until the bankruptcy is discharged before the two years of seasoning will start.

Chapter 13 bankruptcies is an adjustment of debt. It is a way to have a chance to repay all or some of your debts during a repayment period of 3-5 years. The repayment of the debt will be discharged when the repayment period comes to an end. In order to get a mortgage after a Chapter 13 Bankruptcy, you'll need to get permission from your bankruptcy trustee. Below are the requirements for getting a mortgage after a bankruptcy and the amount of time the client will have to season their bankruptcy:

- FHA, USDA, VA (Rural Housing Lending Programs): One year waiting period from the discharge date.

- You qualify for the loan under the program’s underwriting guidelines.

- At least 12 months of the repayment period must have elapsed, and you must have made all required payments on time.

- The bankruptcy Trustee or a Bankruptcy Court judge gives you written approval to take out the loan.

- Conventional: 2 years from discharge date or 4 years from the dismissal date.

- Chapter 13 bankruptcies in which filers made all payments as required are considered “discharged.” The waiting period for these Chapter 13 bankruptcies is two years from the discharge date with a government-sponsored mortgage.

You will be required to season the foreclosure 3 years from the date that the foreclosure was finalized and closed before you will be able to move forward with getting a mortgage.

If you have government funded student loans in collection, our preferred lenders will not finance a mortgage for you until you either pay them off, get them out of collection, or at least have a payment plan in place to repay the debt before the lender will be able to move forward with the mortgage process. This is because FHA loans, USDA loans, VA loans and the Native American Direct Loan are also government funded. We recommend working with our Student Loan Department to see if there is something we can do to help you get the student loan collections taken care of.

If you have past due child/family support showing on you credit reports our preferred lender will require the past due child support to be paid and possibly 12 months of on time payments before they will approve you for a mortgage.

- Child/Family Support is not usually reported to the credit bureaus unless you are delinquent and missed one or several payments. It usually will not show on your credit reports until the child/family support has been reported to a collection agency from the state.

When calculating DTI, the lender will add 5% of total collections to your monthly debt, which can greatly affect the DTI ratio.

When calculating DTI, the lender will add 1% of total student loan debt to your monthly income, which can greatly increase the DTI percentage.

There are different requirements for VA loans only. If you are applying for a VA loan, the lender is only required to add 0.5% of the total student loan amount.

Our preferred lenders will require you to have 2 or more open accounts with at least one year of payment history on an open account showing on your reports.

Rent Reporting will count as a tradeline and history, as long as you have proof that you have been paying the rent for 12+ months, such as cancelled checks or you have been paying through a rent management company. If you cannot prove this to the lender, you will not be able to use it as an open account and payment history for getting a mortgage, although it will still help bring your score higher.

Authorized user accounts do not count as payment history, they can help his score but do not count towards an open tradeline and payment history to the lender when applying for a mortgage.

An installment account is a loan, which is to say it's credit you take out that has to be paid off over time with a set number of scheduled payments. Just like its name, the loan is paid off little by little each month in installments. For example, auto loans, personal loans, student loans, mortgages are all types of installment accounts.

A revolving account gives a borrower flexibility to have an open credit line up to a maximum specified limit. Borrowers have the option to apply for revolving or non-revolving credit. Revolving credit is associated with accounts that have a revolving balance. Credit cards, lines of credit, and home equity lines of credit are some of the most common revolving accounts.

We have to wait for disputes to be complete before sending you over to the lender because if the lender can see that you have accounts in dispute, they are less likely to finance a mortgage. They also will not allow you to have over a certain amount showing previously disputed.

Each lender will have their own process. Typically the lender will take your application and request the documentation they will need. After you send them the documentation they request, they will then pull their credit report and start the mortgage process. The loan officer should be in contact with you, letting you know what the next steps are.

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. This document is based on certain assumptions and it is not a guaranteed loan offer. But, it lets the seller know that you are likely to be able to get financing. Sellers frequently require a prequalification or preapproval letter before accepting your offer on a house.

The lender will reach out to you 3 times. If they are unable to contact you within that timeframe, they will contact CIG and ask the specialist to reach out to you. Once we are able to get in contact with you, and you are still interested in working with our preferred lender, we will refer you back to the lender to continue the mortgage application process.

In community property states, all debts incurred during a marriage automatically become joint debts. In such states, one spouse cannot apply for a mortgage without including the other spouse on the application. Both spouses must sign the mortgage documents, and both spouses' names will appear on the title to the property. As of June 2013, community property states are California, Louisiana, New Mexico, Washington, Arizona, Idaho, Nevada, Texas and Wisconsin. In all other states, one spouse can apply for a mortgage without the other spouse.

Implications:

If your name won't be on the mortgage, the lender won't consider any of your credit, income or employment information when deciding whether to approve the loan. All bills for the mortgage will come in your spouse's name and, unless you live in a community property state, you won't be responsible for paying them. However, you can claim joint ownership of the house if your name is on the title along with your spouse's, even if you're not listed on the mortgage.

Advantages

Some people choose to put only one spouse's name on the mortgage to free up the other spouse's credit for different uses. For example, if only your husband's name is on the mortgage, it won't count against you if you need to apply for a car loan or other revolving debt. Keeping your name off the mortgage may also be beneficial if you have bad credit or high debt, which would affect your ability to qualify jointly. And if you and your husband default on the mortgage, only his credit score will suffer.

Disadvantages

If your spouse has limited income, a low credit score or a large amount of debt, he may not be able to qualify for a mortgage without your help. If he does qualify, his maximum loan amount may be lower than it would have been if you had applied together. If your spouse dies and your name isn't on the mortgage, you may need to apply for a new loan in your own name to keep your home.

If you have money that you plan to use for a down payment, the lender will require it to be deposited in a bank account and aged for at least 60 days. The lender will ask you to document this by showing 2 months of bank statements with the money sitting in an account.

Yes! You will just have to meet mortgage requirements and have previous two years of tax returns filed.

You will be required to get a COE (Certificate of Eligibility) for a VA loan. The lender will ask for this when they take your application and request documentation.

A short sale is an agreement with your mortgage lender to sell your home at a loss or less than what you owe, in order to satisfy a mortgage you cannot afford.

See How We Can Help You

Improve Your Credit

Having good credit opens the door to achieving our financial dreams. We help our members develop a strong credit profile so that they can do just that. What are you waiting for?